Trying Go SimpleTax – A New & Easy Way to Do Your Self-Assessment

Trying Go SimpleTax – A New & Easy Way to Do Your Self-Assessment

I’ve been self-employed for quite a few years and I know that there are two main things that people who are working for themselves are most worried about and they are:

- Not knowing how much work is going to come your way.

- Doing your tax return/self-assessment.

Other than being as awesome as you can in your line of work, there’s not that much you can do to guarantee your business’ success but there’s a way to make filing your self-assessment tax return a lot easier, learn about what expenses you can claim and ensure you avoid costly errors.

SimpleTax is a smart self-assessment tax return filing software that you can use on your computer and/or as an app on your phone or tablet. The software helps you do your tax return properly and correctly even if this is something that you’ve never done before.

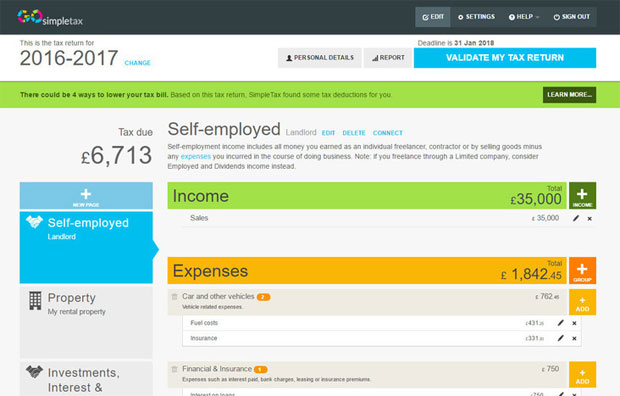

It’s a great idea to help freelancers like myself. I usually just work in a spreadsheet but that doesn’t help me calculate any savings I could be making nor make personalised recommendations like SimpleTax does. The spreadsheet just keeps the jobs and payments organised but I still have to do the calculations at the end of the year when it’s time to do my self-assessment.

Learning about expenses is something that I’ve put off until now but now that I’m trying out this software, I’m picking up tips and am learning about what expenses are allowed in my specific circumstances.

SimpleTax also runs hundreds of error checks to ensure that there are no mistakes which is very reassuring and that you file an accurate tax return. You file the return through SimpleTax and it only takes a few minutes, then you’ll get a confirmation email to let you know that it has gone through to HMRC. The software is officially recognised by HMRC and protected by 256-bit secure connections to make it as safe as possible. Your tax returns are stored online and you can also choose to save them as PDFs locally.

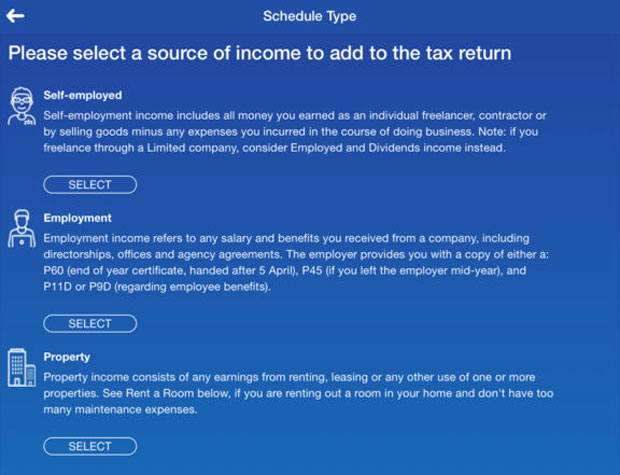

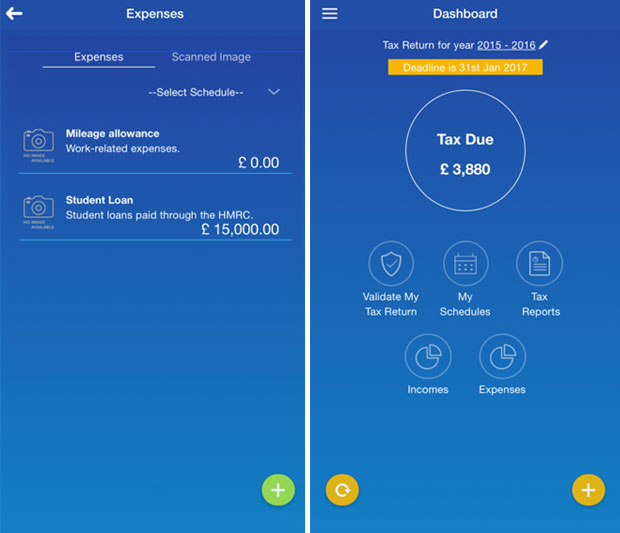

(Example from SimpleTax.)

The app is free to download and when you use the software on your computer, you don’t have to install anything — it’s all done online.

A few of the things that I really like about this software are:

- It’s so easy and quick to get started!

- There are three different levels to choose from depending on your needs and all offer a free 14-day trial.

- The app and the desktop software are very nicely designed.

- SimpleTax is really simple to use and very intuitive even for tax beginners.

- The language is easy to understand even if you’re not an accountant!

- There’s a support team that quickly answers any questions you might have and that is there for you if you need any assistance.

- It’s affordable! It only costs between £12.50 and £30.00 per tax year depending on which option you go for.

(Example from SimpleTax.)

I prefer using the online version on my computer to the app but that’s just because I like working on a bigger screen and with a keyboard. The app is really well designed and simple to use too and it’s really helpful when you need to add things when you’re away from the office. It’s always best to add things as they come up so that you don’t risk forgetting anything.

I’m only just getting started as I created my account a few weeks ago so these are my initial thoughts of SimpleTax. It’s the perfect time to try a new software like this since the new tax year has only just begun. Find out more and get a free trial yourself here.

PR Collaboration.